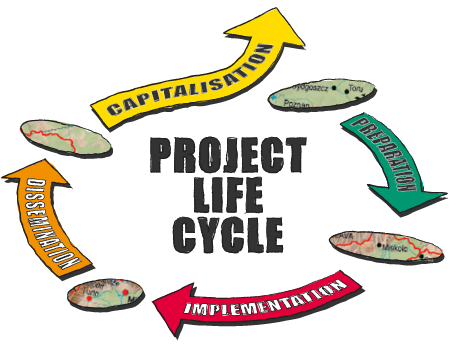

Making preparations

To begin at the very beginning: networking events were organised to help regions present their ideas for projects and find potential partners to proceed with.

An example of this was the second EU Interregional Cooperation Forum that

took place in 2008. The event brought together in Lille, France over

1,000 participants from every European

country.

This two-day event combined plenary sessions with smaller information and

networking activities.

A new feature was introduced to improve partner search: speed dating

sessions. Pairs of project promoters had two minutes to present

their project idea, before moving on to the next person. Each session

allowed the maximum contact between different project promoters on the same

theme. These ‘speed dates’ proved very effective, helping

many regions to find a good match.

When a project outline was in place, Lead Applicants – the regions that took the initiative for new projects – could attend seminars to help them prepare their application. The seminars included information on the technical and quality requirements of the programme.

Take-off

Once their application was successful, regions that were Lead Partners – bearing chief responsibility for the implementation of the project – could then attend further seminars to network and exchange experiences with their peers and also to give further information on the administrative, financial and publicity requirements related to INTERREG IVC.

The Programme Secretariat continued to be involved in up and running projects, closely monitoring activities and results and giving Lead Partners feedback to keep projects firmly on course.

Sharing inspiration

Project partners were invited to attend events such as OPEN DAYS – European Week of Regions and Cities where they could present and promote their project.

In 2012, INTERREG IVC developed an exhibition that presented the results of interregional cooperation. It consisted of 11 interactive thematic stands that gave an overview of about 60 good practices identified by the INTERREG IVC projects.

INTERREG IVC was present at over 200 other events to help share inspirational ideas and give them greater momentum.

Several INTERREG IVC projects were finalists for the prestigious RegioStars Award, an annual award highlighting the most inspiring and innovative European projects funded by the EU’s Cohesion Policy. In 2012, GRaBS (Green and Blue Space Adaptation for Urban Areas and Eco Towns) won the award in the category ‘Sustainable growth’.

Lessons learned

Finally, to ensure that valuable information and lessons learned were not lost, an online Good Practice database was set up, containing 1,300 examples of good policy practices. Project partners uploaded information on their project here, to share with other INTERREG IVC participants and European regions in general. This provided a solid basis for the new INTERREG EUROPE project, which kicked off in 2015 (see chapter ‘Moving forward’ for more details).

www.fin-en.eu

Click on the map to see the institutions involved in the project.

Lead partner

Lead partner Project partner

Project partnerNew ways to finance SMEs

Small and medium-sized enterprises (SMEs) are often a driving force for innovation and job creation. Unfortunately, in the current economic situation, many promising start-ups and growing companies are unable to acquire funds from banks or private investors to finance their business plans.

Thanks to new EU-legislation, regions have the freedom to create new financial instruments to help SMEs gain access to EU-funds. The FIN-EN project created a platform on which regions could exchange their experiences with these new instruments and identify good practices to share and transfer.

Engineering financial instruments

The first step in the FIN-EN process was a so-called gap analysis: what do SMEs need, what can private investors offer and which gap do regional governments need to bridge? Regional governments also used this stage to assess which sectors were the most promising and select corresponding SMEs to invest in.

The second step was to engineer and implement the financial instruments to fulfil the SMEs’ needs and at the same time use EU-funds as wisely as possible. Regional governments could learn from each other’s experience and share good practices during project meetings and on FIN-EN’s online platform.

Finally, financial instruments implemented were assessed to discover whether the right choices had been made and to learn which improvements could be made for future investments.

Evaluation and analysis

One of the good practices defined by FIN-EN was a quantitative and qualitative evaluation by Berlin-based Investitionsbank Berlin (IBB). With the help of a local credit research company IBB interviewed 1,000 Berlin-based SMEs to find out more about their access to (debt) finance, the reasons why finance had previously been rejected and whether they had used public schemes to acquire funding before.

The data was analysed and published in a 50-page report, which IBB and project partners used to evaluate, improve or adjust financial instruments. IBB also used the data in ex-ante evaluations, to determine promising sectors for investment.

“The exchange of experiences among a widespread network of highly qualified partners across Europe (13 regions from 13 different Member States) – all deeply involved in the overall process of setting up financial instruments (covering the programming, implementing and monitoring phase through various project activities) – has enhanced our knowledge on the subject. It has also provided the consortium with new inputs on financial instruments to be addressed within EU institutions during the current 2014-2020 period.”

Paolo Zaggia – Head of EU Department in Finlombarda, Italy (lead partner)